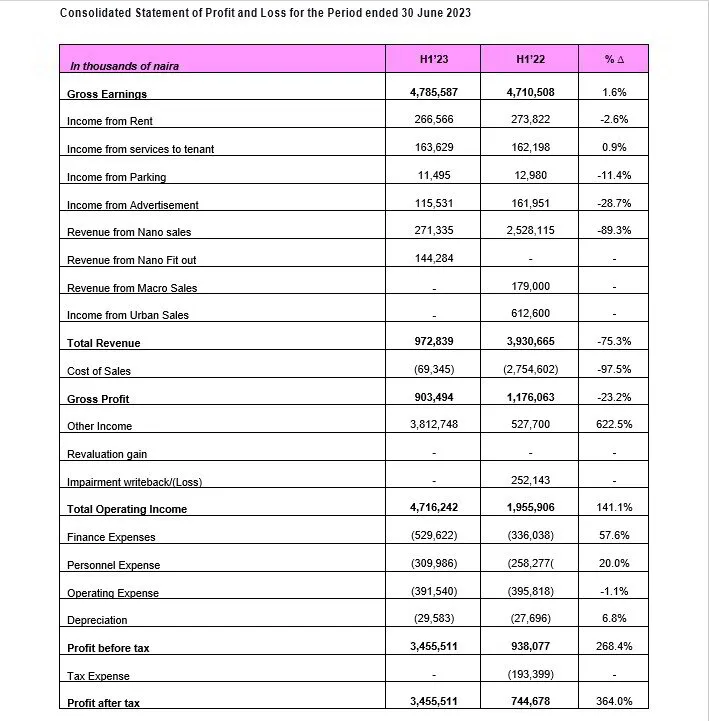

Consolidated Statement of Profit or Loss

- Gross earnings of ₦4.8 billion (H1 2022: ₦4.7 billion)

- Total revenue of ₦972.8 million (H1 2022: ₦3.9 billion)

- Gross profit of ₦903.5 million (H1 2022: ₦1.2 billion)

- Total operating income ₦4.7 billion (H1 2022: ₦2.0 billion)

- Adjusted operating expenses of ₦731.1 million (H1 2022: ₦681.8 million)

- Adjusted operating profit of ₦4.0 billion (H1 2022: ₦1.3 billion)

- Profit before income tax of ₦3.5 billion (H1 2022: ₦938.1 million)

- Profit after tax of ₦3.5 billion (H1 2022: ₦744.7 million)

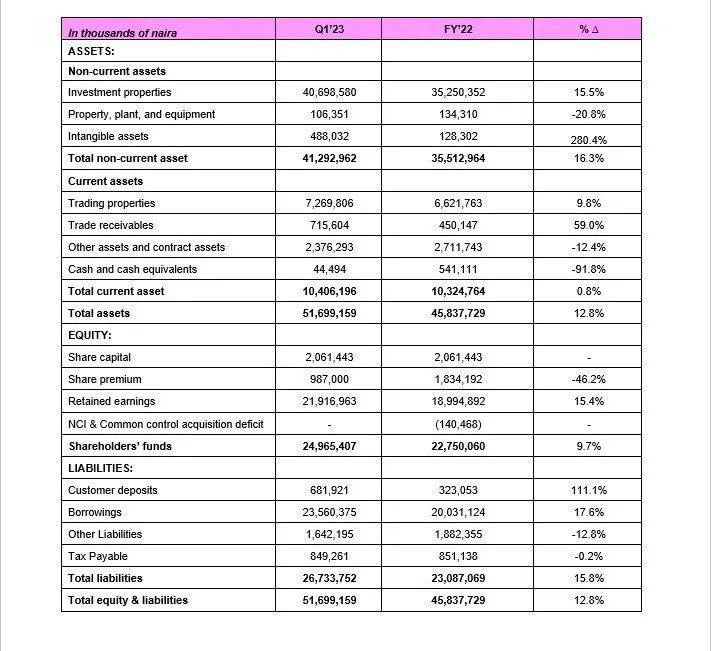

Consolidated Statement of Financial Position

- Total assets of ₦51.7 billion (FY 2022: ₦45.8 billion)

- Total liabilities of ₦26.7 billion (FY 2022: ₦23.1 billion)

- Shareholders’ funds of ₦25.0 billion (FY 2022: ₦22.8 billion)

Key Ratios

- Rental income contribution of 5.6% (H1 2022: 5.8%)

- Rental yield of 4.4% (H1 2022: 4.6%)

- Adjusted operating profit margin of 83.3% (H1 2022: 27.0%)

- Profit before tax margin of 72.2% (H1 2022: 19.9%)

- Profit after tax margin of 72.2% (H1 2022: 15.8%)

- Return on asset of 13.4% (H1 2022: 3.3%)

- Return on equity of 27.7% (H1 2022: 6.6%)

- Total liabilities to equity of 1.1x (FY 2022: 1.0x)

- Total liabilities to asset of 0.5x (FY 2022: 0.5x)

- Total borrowings to equity of 0.9x (FY 2022: 0.9x)

Commenting on the performance, the Chief Executive Officer, Mr Laide Agboola, stated:

‘’ We have reached the midpoint of the year with tremendous achievements and solid progress, reflecting

our unwavering commitment to excellence and growth in a dynamic market. In the first half of 2023, we

achieved remarkable financial results, demonstrating resilience and adaptability amidst challenging market

conditions. This is evident in our bottom line which increased by 364% compared to the same period last

year.

We are still very much on course with the commissioning of Purple Lekki in the third quarter and as the

second half of 2023 evolves, we are cautiously optimistic about the opportunities and challenges that lie

ahead. We will maintain our strategic focus on delivering high-quality developments, building strategic

partnerships, and leveraging digital innovations to ensure continued growth and profitability. “

Financial Review

Gross earnings of ₦4.8 billion, up 1.6% (H1 2022: ₦4.7 billion). Key drivers of gross earnings:

- Revenue from the sale of trading properties under development (8.7% of gross earnings) of ₦415.6

million (H1 2022: ₦3.3 billion; 70.5% of gross earnings). The major driver of this decline was the reduction

in revenue from projects as a result of slower construction activities in H1 2023 relative to the prior year.

- Rental income (5.6% of gross earnings) of ₦266.6 million from ₦273.8 million (5.8% of gross earnings)

recorded in H1 2022. During the period, the value of our investment properties increased by 15.5% to

₦40.7 billion which resulted to a rental yield of 0.1% in H1 2023 (H1 2022: 6.1%).

- Revenue from services 4 (6.1% of gross earnings) of ₦290.7 million from ₦337.1 million (7.2% of gross

earnings) in H1 2022. This decline was driven by slight decreases in the income generated from utilities

₦101.7 million (H1 2022: ₦117.2 million) and advertisement ₦115.5 million (H1 2022: ₦162.0 million).

- Other income 5 (79.7% of gross earnings) of ₦3.8 billion from ₦779.8 million (16.6% of gross earnings) in

H1 2022. This was majorly driven by a 677.8% increase in revaluation gain to ₦3.7 billion (H1 2022:

₦480.1 million).

- Costs of sales of ₦69.3 million (H1 2022: ₦2.8 billion). This decline reflected the decrease in sales of trading properties under development which ensued from the earlier mentioned slowdown in construction activities in the period.

- Gross profit of ₦903.5 million in H1 2023 (H1 2022: ₦1.2 billion). This 23.2% decline was primarily due to

lower revenue from selling trading properties under development as well as revenue from services in H1 2023

compared to H1 2022.

- Operating income of ₦4.7 billion (H1 2022: ₦2.0 billion). This was majorly driven by a 622.5% growth in other income to ₦3.8 billion (H1 2022: ₦527.7 million).

- Adjusted operating expenses 6 of ₦731.1 million (15.3% of gross earnings), from ₦681.8 million (14.5% of gross earnings) in H1 2022. This is attributable to:

- Operating expenses (53.6% of adjusted operating expenses) of ₦391.5 million in H1 2023 from ₦395.8 million in H1 2022 (58.1% of adjusted operating expenses) – a decline of 1.1% - benefitting majorly from a 64.7% decrease in advertisement and public relations to ₦10.8 million (H1 2022: ₦30.5 million).

- Personnel expenses (42.4% of adjusted operating expenses) grew by 20.0% to ₦310.0 million in H1 2023 from ₦258.3 million in H1 2022 (37.9% of adjusted operating expenses); primarily driven by a 73.0% increase in other outsourced staff cost to ₦156.7 million (H1 2022: ₦90.6 million). However, outsourced staff salaries declined by 11.9% to ₦91.0 million (H1 2022: ₦103.3 million).

Depreciation (4.0% of adjusted operating expenses) of ₦29.6 million in H1 2023 from ₦27.7 million in H1 2022 (4.0% of adjusted operating expenses)

This led to an Adjusted operating profit of ₦4.0 billion from ₦1.3 billion in H1 2022.

Finance expenses grew by 57.6% to ₦529.6 million (H1:2022 ₦336.0 million) leading to an interest coverage ratio of 3.8x (H1 2022: 7.5x). We remain committed to maintaining a healthy interest coverage ratio, and our focus will be on growing our operating profit to ensure we remain resilient in servicing our financial obligations.

Profit after tax of ₦3.5 billion (H1 2022: ₦744.7 million) resulting in a margin of 72.2% (H1 2022: 15.8%).

Year-to-date, total assets grew by 12.8% to ₦51.7 billion (FY 2022: ₦45.8 billion). Non-current assets grew by 16.3% to ₦41.3 billion (FY 2022 ₦35.5 billion) which was driven by a 15.5% growth in investment properties to ₦40.7 billion (FY 2022: ₦35.3 billion). Current assets increased by 0.8% to ₦10.4 billion (FY 2022: ₦10.3billion) driven largely by a 9.8% increase in trading properties to ₦7.3 billion (FY 2022: ₦6.6 billion).

Shareholders’ funds grew by 9.4% to ₦25.0 billion from ₦22.8 billion due to a 15.4% increase in retained earnings to ₦21.9 billion (FY 2022: ₦19.0 billion).

Total liabilities grew by 15.8% to ₦26.7 billion (FY 2022: ₦23.1 billion), driven by a 17.6% increase in borrowings to ₦23.6 billion (FY 2022: ₦20.0 billion).

Outlook

As we navigate the second half of 2023, we are pushing forward with our strategic initiatives that focus on digital innovations and expansion of our property portfolio, while maintaining our commitment to excellence and growth amidst the ever-evolving market dynamics.

We are thrilled to announce that the retail section in Purple Lekki will be opened in the third quarter marking a key milestone in our growth trajectory. Given the prime location and the uniqueness of the offering, we anticipate strong consumer interest and a significant contribution to our revenue and income streams. The opening is poised to trigger long-term financing from our local and international partners, therefore, providing us with the necessary capital to continue executing our growth strategies while maintaining a healthy balance sheet and capital structure.

In line with our commitment to leverage digital innovation, we are also excited about the imminent launch of our fractional investment app. This app, following the successful completion of its testing phase in August, is

expected to open up new opportunities for investors by offering an accessible and efficient platform to invest in real estate. We anticipate the app will enhance customer experience, increase our market reach, and thereby diversify our revenue streams.

Notwithstanding the inherent challenges, we are cautiously optimistic about the evolving market conditions and, we expect our overall performance in the second half of the year to mirror the strong results achieved in the first half.

Contact Information

For investor inquiries

Investor Relations

investors@purple.xyz

telephone:

Abasi-Ene Bassey

Oluyemisi Lanre-Phillips

teampurple@vaerdi.org